When you set up a yoga business, you generally focus on the service that you provide your customers and clients with. You will spend hours on end ensuring that your studio is up to scratch, that you are providing a variety of different classes for individuals of different ability levels, and that you have high-quality accessories available, such as mats, resistance bands, and steps. However, you do need to take the less fun issue of legal matters surrounding your business into account at all times too. Each year, you will have to file a tax return for your business. Here are the basics to help you get this task complete with as little stress as possible.

Hire an Accountant

The easiest way to deal with your taxes, and the most reliable way to file your taxes on time without mistakes, is to hire a professional accountant. This individual will take care of all of your tax-based work on your behalf.

Remember Tax Deductible Expenses

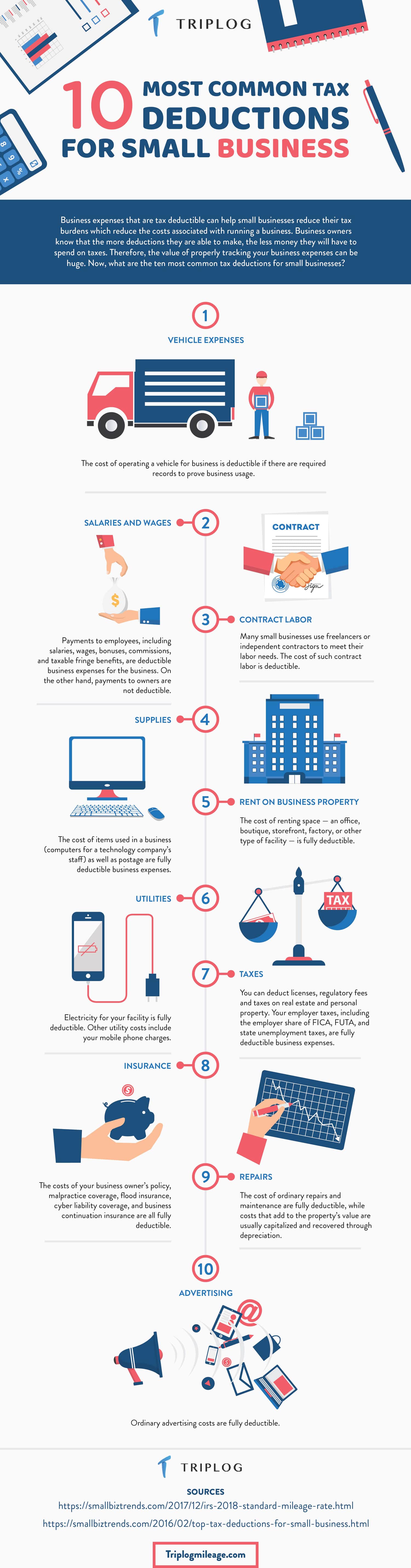

Chances are that you have forked out for some items that are tax deductible throughout the process of setting your business up and keeping it up and running. The infographic from TripLog below will provide you with further information regarding some of the most common tax deductions for small businesses!

Infographic Design By TripLog

0 Comments